Business Facilitation Center provides consultancy and end to end assistance for obtaining your Shops and Establishments Act licence. If you want expert help, you can take our service and complete your registration without complications.

If you are starting a business in Maharashtra, one of your first legal requirements is obtaining your shop act licence. Whether you run a small shop, service unit, startup, consultancy, online business, or a company with employees, compliance with the Shops and Establishments Act is essential. Under this law, businesses must either submit Form-G Intimation or obtain Form-B Registration, depending on the number of workers they employ.

What is the Shops and Establishments Act

The Shops and Establishments Act regulates the working conditions, employment terms, and operating rules of commercial establishments across Maharashtra. Every business must either file an intimation or complete full registration to remain legally compliant.

It covers businesses such as:

- Shops

- Commercial offices

- Online businesses operating from home or co working spaces

- Service providers

- Restaurants and cafes

- Warehouses

- Small manufacturing units

- Startups

Whether you need a shop act registration or a gumasta licence, the Act ensures your business is legally recognized by the local authorities.

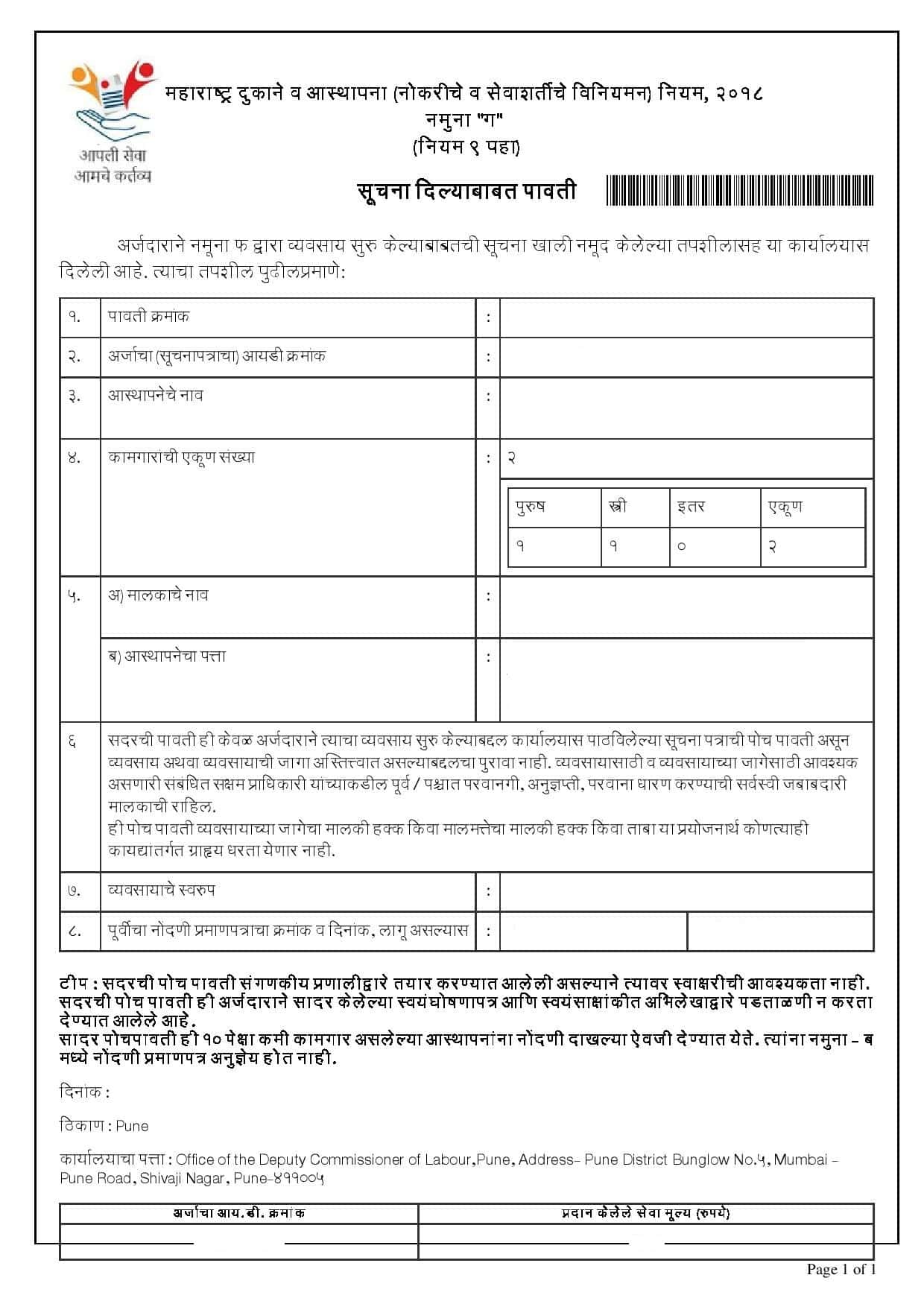

Shops & Establishments Act (Form-G Intimation)

Form-G Intimation applies to businesses that have fewer than ten workers. Instead of getting a full certificate, these businesses file a simple intimation to notify the government that they have commenced operations.

If your business is small or newly launched, this is usually the first step before your workforce increases.

Purpose of Form-G

Form-G is the official acknowledgement that your business has submitted Form-F (the intimation of commencement). After submitting the details online, the government issues Form-G Intimation as a receipt.

This receipt serves as legal proof that your business is registered under the Shops and Establishments Act.

Many small businesses use Form-G as their gumasta license until they reach ten employees.

Details Included in Form-G

Form-G contains essential business details such as:

- Name of the business

- Name of the employer

- Business address

- Nature of business

- Number of workers

- Acknowledgement number

This receipt must be saved and shown to authorities whenever required.

Why Form-G is Important

Even though it is not a full shop act licence, Form-G provides strong legal credibility. Banks, online marketplaces, and vendors often accept it when opening accounts or verifying business identity.

Benefits include:

- Proof of lawful business operation

- Recognition under labour laws

- Smooth bank account opening (depends on bank)

- Easier approvals for other licences

- Compliance with state regulations

If you are searching for gumasta license online for a small business, Form-G often fulfills the requirement.

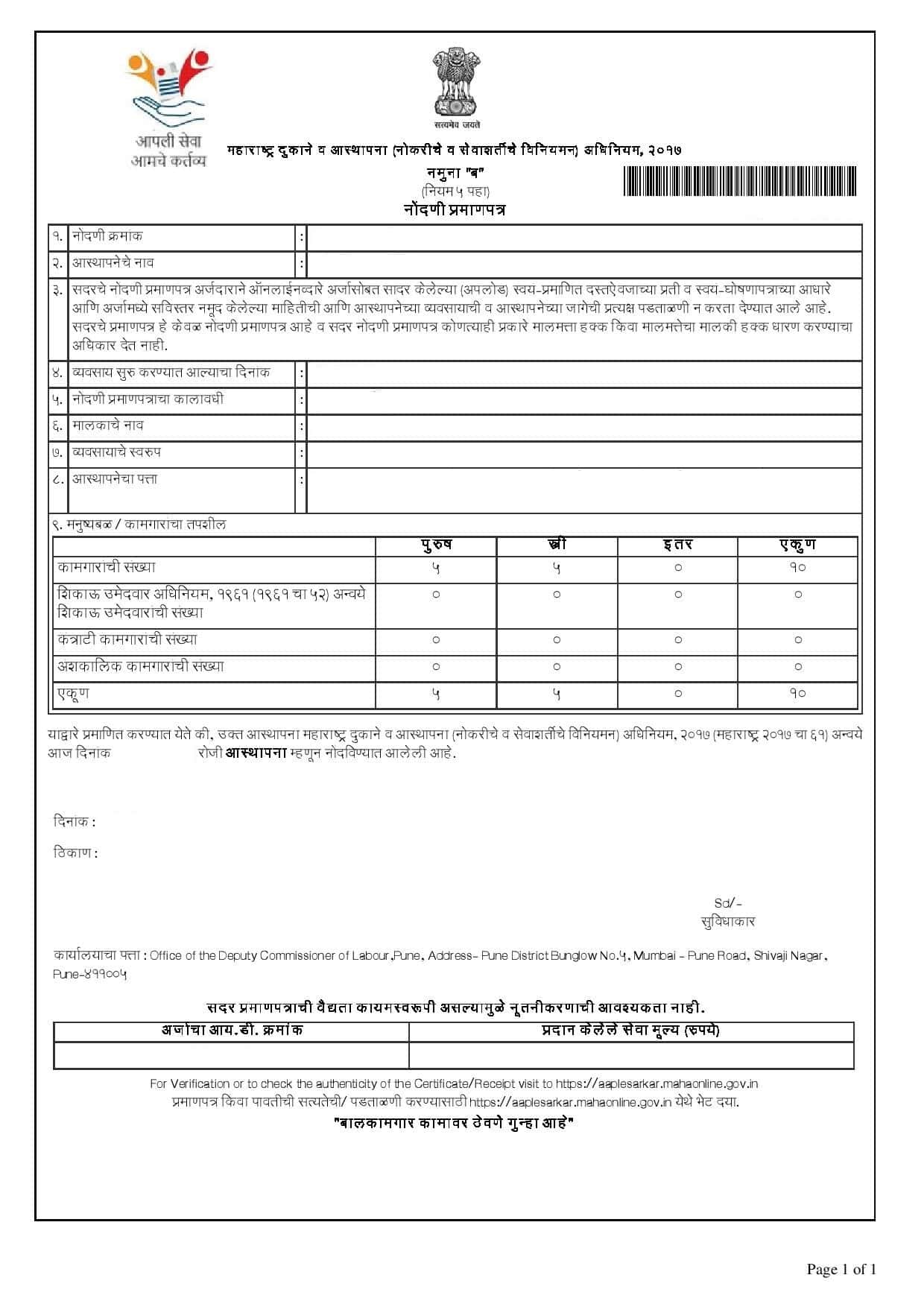

Shops and Establishments Act (Form-B Registration)

Who needs Form-B

Form-B applies to businesses that employ ten or more workers. This is the official shop act licence also known as the shop act registration certificate or gumasta license.

This certificate is mandatory and must be displayed at the business premises.

Purpose of Form-B

Form-B is the primary legal document that certifies your establishment under the Shops and Establishments Act. Once issued, your business receives Form-B along with the signed registration certificate.

Details Included in Form-B

A typical Form-B Certificate includes:

- Registration number

- Name and address of the business

- Name of the employer and manager

- Nature of business

- Date of commencement

- Validity period of registration

- Authorized signature of the issuing authority

This certificate is what most people refer to when they search for shop act licence online or gumasta registration.

Difference Between Form-G and Form-B

| Requirement | Form G Intimation | Form B Registration |

|---|---|---|

| Number of Employees | Fewer than 10 | Ten or more |

| Type of Document | Acknowledgement Receipt | Full Registration Certificate |

| Common Name | Gumasta License for small units | Shop Act Licence |

| Mandatory Display | Required at business premises | Required at business premises |

| Validity | Until workforce increases | Up to ten years |

| When Needed | Startup stage or minimal workforce | Growing or established businesses |

Documents Required for Shops & Establishments Act

| Constitution | Documents for Form-G (Intimation, <10 employees) | Documents for Form-B (Registration, ≥10 employees) |

|---|---|---|

| Proprietorship |

|

|

| Partnership Firm |

|

|

| Limited Liability Partnership (LLP) |

|

|

| Private Limited Company |

|

|

| Public Limited Company |

|

|

| Co-operative Society |

|

|

| Trust |

|

|

These documents are also used for gumasta registration and gumasta license online applications.

Benefits of Shop Act Licence

Whether you get Form-G or Form-B, your shop act licence offers several advantages:

- Official recognition of your business

- Easy bank account opening (depends on bank)

- Smooth hiring and payroll compliance

- Access to government benefits and schemes

- Fulfillment of mandatory state regulations

- Strong business credibility with clients and suppliers

Many businesses also require a shop and establishment license to apply for GST, MSME certification, FSSAI, and other approvals.

How to Apply for Shop Act Licence Online

Applying for a shop act licence online is simple. The steps include:

- Create your login on the state portal

- Choose Form-F or Form-A depending on your workforce

- Fill in establishment details

- Upload documents

- Pay the required fee

- Download Form-G or Form-B once approved

Every step is completed digitally, which makes gumasta license online applications fast and efficient.

When to Upgrade From Form-G to Form-B

If your business grows and your workforce reaches ten or more employees, you must apply for the full shop act registration immediately. Form-G will no longer be valid, and you must obtain your Form-B licence.

Note: Additional information or supporting documents may be requested by the competent authority during verification if required.